Mastering the Art of Risk vs Reward vs Folly

Sept 29, 2023

During the dot-com era, many individuals ridiculed Buffett for his refusal to invest in ventures that contradicted his principles. These ventures primarily involved pouring substantial amounts of money into companies whose main asset was nothing more than hot air. Essentially, all they had to do was attach the label “dot-com” to their name, and their stock prices would skyrocket. However, years later, the majority of these so-called experts, if not all of them, vanished when the dot-com bubble burst in flames.

We noted this phenomenon and applied our observations before the financial crisis of 2008-2009, which actually began in 2007. In 2006, almost a year before the market peaked, we advised our subscribers to exit the housing market. Many of them were displeased at the time as the housing market continued to thrive. However, when it eventually crashed, the screams of those who had lost all their gains and more could be heard from miles away.

So, what is the underlying message of this conversation? It’s really quite simple: one should refrain from pursuing investments solely to chase them and go along with the crowd. While it is true that many stocks are currently soaring to new heights, a significant number of today’s investors have adopted a “make it big or go home” mentality, which often leads to disastrous outcomes. Therefore, one of two scenarios must unfold: either the markets or the companies that experienced rapid gains due to FOMO (fear of missing out) must experience a significant correction, or bearish sentiment must prevail. Until one of these events occurs, we remain unconcerned about others’ opinions and maintain a cautious approach.

Let’s revisit this topic in 15 months and see who was right and how many of those who foolishly chased after stocks are left to reap the rewards. Bulls and bears sometimes profit, but “pigs always get slaughtered.” In conclusion, chasing investments or following the crowd is not true investing; it is speculation at best and a perilous endeavour at worst (death wish), and this brings to mind a play we were trying to get in years ago.

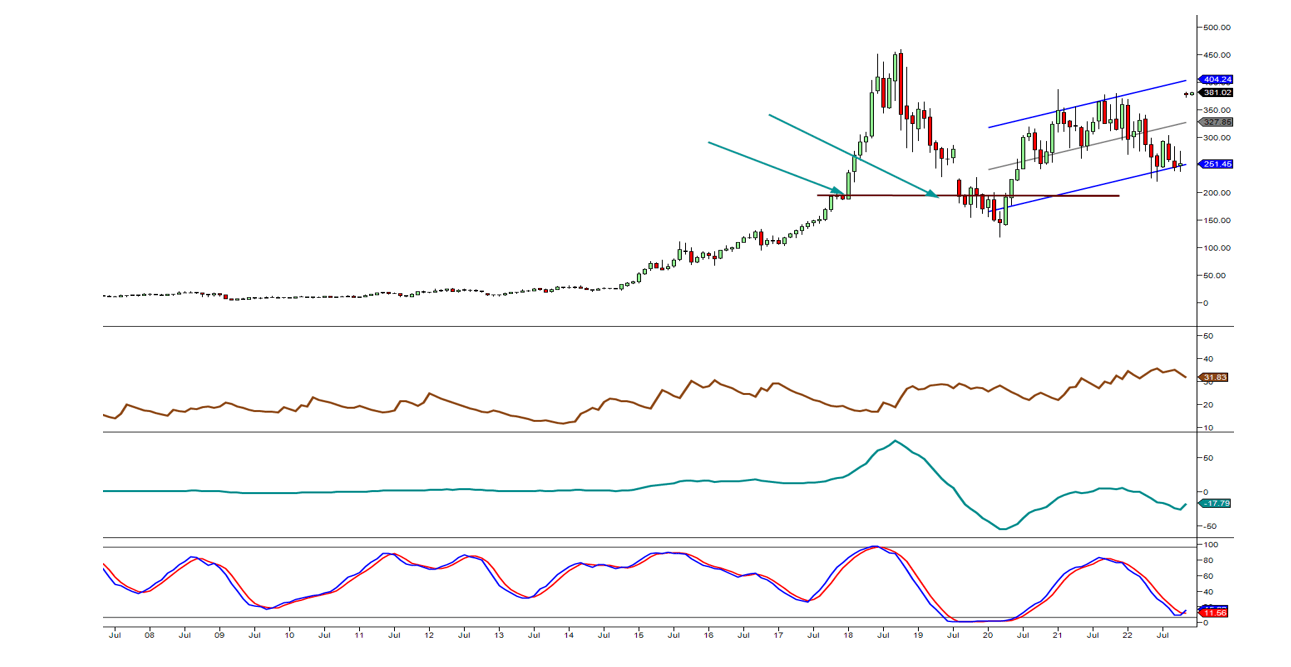

Monthly chart of ABMD

Analyzing Risk vs Reward: Learning from Past Mistakes

Take a look at the brown line marked by the two green arrows. Our risk-to-reward models indicated that only a price below this line would be worth the risk. Nonetheless, the stock did not pull back, and numerous subscribers complained that we were too conservative with our entry points. Consequently, they opted to chase the stock. Unfortunately, most of them failed to capitalise on their profits promptly, resulting in substantial losses that left them thoroughly roasted. Eventually, the stock gave up all its gains and more, and JNJ finally acquired it.

In March 2020, when the stock appeared somewhat appealing, we had many other, and arguably better, candidates to choose from, so we decided to overlook this particular opportunity.

Currently, stocks such as QCOM, WOLF, TSM, AMAT, CYBR, and others fall into the attractive category, and we will adjust our entry points accordingly for these plays.

Conclusion: Embrace the Thrill of Smart Investing

In the ever-evolving landscape of investment, where fortunes are made and lost in the blink of an eye, one principle stands unwavering: the art of balancing risk versus reward versus folly. As we journeyed through the annals of financial history, we encountered stories of triumph and tragedy, of individuals who either reaped the rewards of prudence or fell victim to the siren call of speculative frenzy.

Take the dot-com era, for instance, a time when the world seemed intoxicated with the promise of “get rich quick” schemes. Many ridiculed the legendary Warren Buffett for his steadfast refusal to invest in companies with nothing more than hot air. They watched as stocks with “dot-com” attached to their names soared to the heavens, only to come crashing down like Icarus. Buffett’s prudence was vindicated, and the chorus of naysayers fell silent.

Similarly, during the tumultuous days leading up to the 2008-2009 financial crisis, we urged our subscribers to exit the housing market, much to their chagrin. Yet, when the market imploded, their losses reverberated like thunder. Lessons were learned, but the scars remained.

What message do these stories convey? True investing is not a reckless chase or a blind following of the crowd. It’s a deliberate, calculated art, a dance with risk and reward that requires insight, discipline, and a willingness to chart one’s course in uncharted waters.

As we peer into the future, with stocks soaring to new heights and a cacophony of voices touting “get rich quick” schemes, remember: Bulls and bears may profit, but “pigs always get slaughtered.” The true investor, the master of risk, reward, and folly, does not tread lightly but moves with purpose.

In conclusion, pursuing financial success is not for the faint of heart. It’s an exhilarating journey filled with challenges, opportunities, pitfalls, and triumphs. Embrace the thrill, for the true art of investing comes to life in the mastery of risk versus reward versus folly.

Discover the Exceptional: Must-Read Articles Unveiled

Time Capsule: Unveiling Behavioral and Mass Psychology Trends